Resolution criteria

This market will resolve based on the Federal Reserve's interest rate decision announced at the conclusion of the Federal Open Market Committee (FOMC) meeting scheduled for September 16–17, 2025. The possible outcomes are:

Increase: The FOMC raises the target range for the federal funds rate.

No change: The FOMC maintains the current target range for the federal funds rate.

25 bps decrease: The FOMC lowers the target range by 25 basis points (0.25 percentage points).

50+ bps decrease: The FOMC lowers the target range by 50 or more basis points (0.50 percentage points or more).

The official FOMC statement, typically released at 2:00 p.m. ET on the final day of the meeting, will serve as the primary source for resolution. The statement can be found on the Federal Reserve's website: (federalreserve.gov)

Background

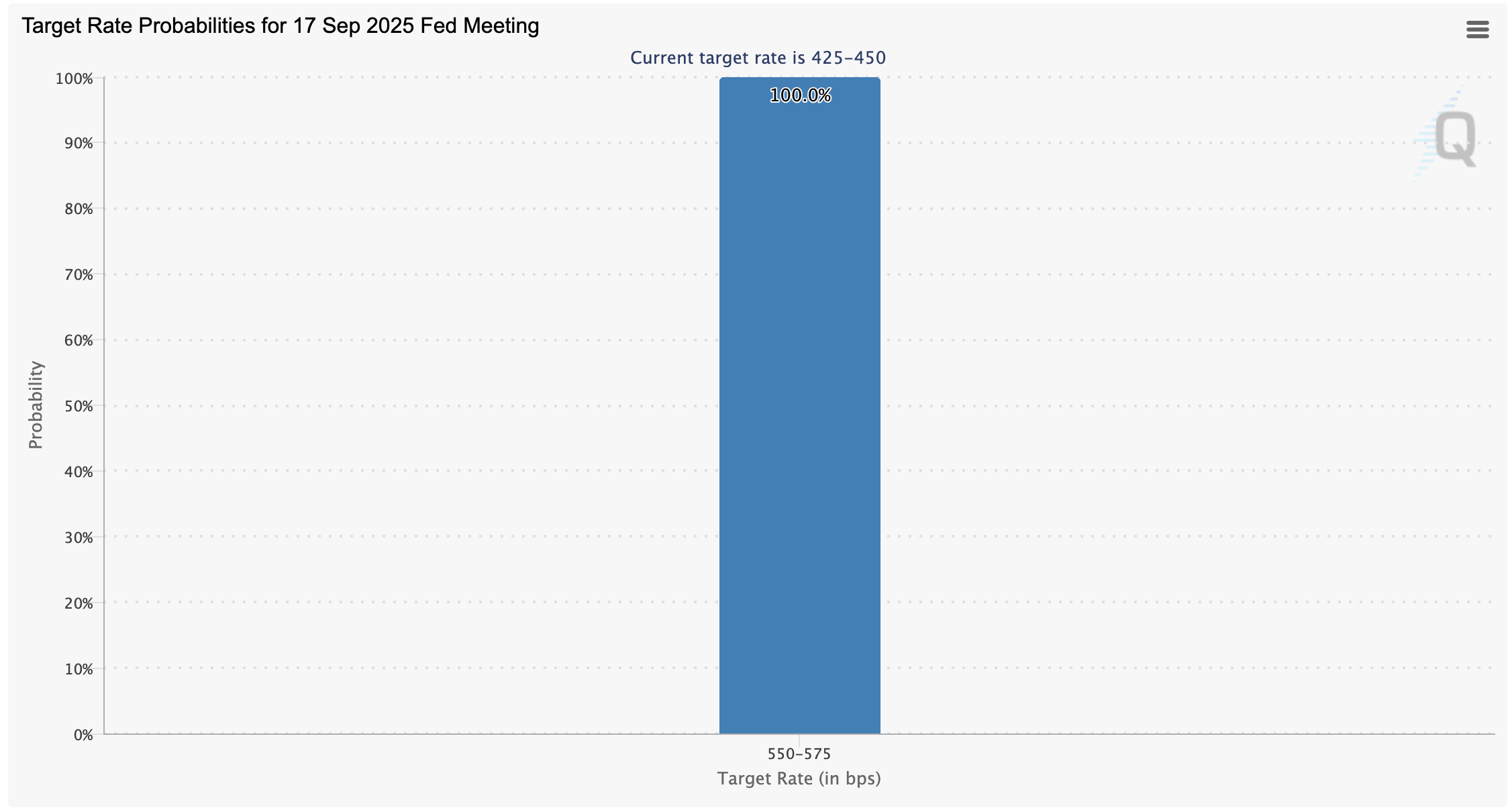

As of August 1, 2025, the federal funds rate target range is 4.25% to 4.50%, unchanged since December 2024. Recent FOMC meetings have maintained this rate, with the most recent decision on July 30, 2025, resulting in a 9–2 vote to hold rates steady. Dissenting votes from Governors Michelle Bowman and Christopher Waller favored a rate cut, indicating internal debate within the committee. (reuters.com)

Economic indicators present a mixed picture:

Inflation: The Personal Consumption Expenditures (PCE) index, the Fed's preferred inflation measure, showed a slight increase in May 2025, suggesting inflation remains above the 2% target. (ainvest.com)

Labor Market: While the labor market remains resilient, recent data indicates a slowdown in job gains, with only 73,000 jobs added in July 2025. (apnews.com)

Economic Growth: Gross Domestic Product (GDP) growth has moderated, with Q2 2025 GDP exceeding forecasts at 3%, driven by decreased imports, but consumer spending has slowed slightly. (kiplinger.com)

Additionally, President Donald Trump has publicly pressured the Federal Reserve to lower interest rates, criticizing Chair Jerome Powell and advocating for rate cuts to stimulate economic growth. (ft.com)

Considerations

Market expectations for a September rate cut have fluctuated. As of late July 2025, futures markets indicated a 50% probability of a rate cut in September, down from 65% earlier in the month. (reuters.com) Analysts are divided, with some forecasting rate cuts later in 2025, while others anticipate the Fed will maintain current rates amid economic uncertainties. (kiplinger.com)

Traders should monitor upcoming economic data releases, including inflation reports and labor market statistics, as well as statements from Federal Reserve officials, to gauge the likelihood of a rate change in September.

@Eliza I'm not a Finance Guy but my basic understanding is that, all else equal, the most direct impacts of a lower Fed rate are:

(a) The value of fed funds futures (which exist to predict/hedge against the effective rate) change (for future months) or are settled to 100 - the average effective rate for the contract month

(b) Bonds issued before the change go up in market price (since they retain the old higher rate of interest)

(c) Equities (and other riskier assets) look better vs the risk free rate of return, so on net demand shifts in that direction their value goes up.

As to what you do with the information the market gives you based on this, assuming that this market is priced perfectly correctly:

You could, in principle, buy/sell fed funds futures for positive EV:

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html

Pick a month that is whole between the two next Fed meetings (for ease of maths, otherwise you have to time-average rates across the change) e.g. October.

Take the probabilities implied by this market, assuming the effective rate will be at the midpoint of the target range (not quite correct, but close enough for illustrative purposes): 0.32 x ((4.25+4.50)/2) + 0.67 x ((4.00+4.25)/2) + 0.01 x((3.75+4.00)/2) = 4.2075

Subtract this from 100: this is your fair value (95.7925)

At time of writing, the actual fed funds futures market for October is priced at 95.86. 95.7925 is less than 95.86, so you should sell* fed funds futures.

* This is obviously not financial advice

@Eliza based on the fact that it predicts lowering rates investing it would be good, however everything is already priced in

@Eliza based on the fact that it predicts lowering rates investing it would be good, however everything is already priced in

not financial advice

I feel like I'm taking crazy pills. CME's FedWatch has this at 87% right now. What do ya'll know??

@SemioticRivalry Is FedWatch not essentially a prediction market? One with far greater volume than Kalshi or Polymarket or any officially labeled prediction market?

@jessald the fed futures markets are continuous and pricing in slightly different things than the prediction markets which causes some differences between the two

@jessald FedWatch overestimates cut probabilities bc they assume there’s either no cut or a 25bps cut, with the expected change from larger cuts ‘smooshed’ into the probability of a 25bps cut

eg say futures traders it's 30% chance of no change, 65% 25bps cut, 5% 50bps cut. so expected rate change is 0.3*0 - 0.65*25 - 0.05*50 = -18.75bps

FedWatch asks “suppose there’s no change with probability p, and 25bps cut with probability (1-p), what p fits the 18.75bps discount in 30 day rate futures?”

i.e. they solve p*0 - (1-p)*25 = -18.75, hence p=0.75. which is greater than 70%, what traders think the probability is!