Resolution Criteria

This market resolves YES if Bitcoin's price is below $80,000 USD at the end of November 28, 2025 (11:59 PM CET / French time). The price will be determined using Google Finance. Resolution will be based on the closing price displayed on Google Finance for that date.

Considerations

The market resolves based on a single price point on a specific date. Bitcoin exhibits high intraday volatility, so the closing price on November 28 may differ significantly from prices earlier that day. Traders should monitor Google Finance directly for the official closing price on the resolution date.

Update 2025-11-21 (PST) (AI summary of creator comment): The creator has clarified that they are viewing Google Finance in French time zone, but notes that Google Finance displays prices one hour behind their current French time (e.g., showing 10:14 PM when local time is 11:14 PM). This may affect which specific timestamp is used for resolution.

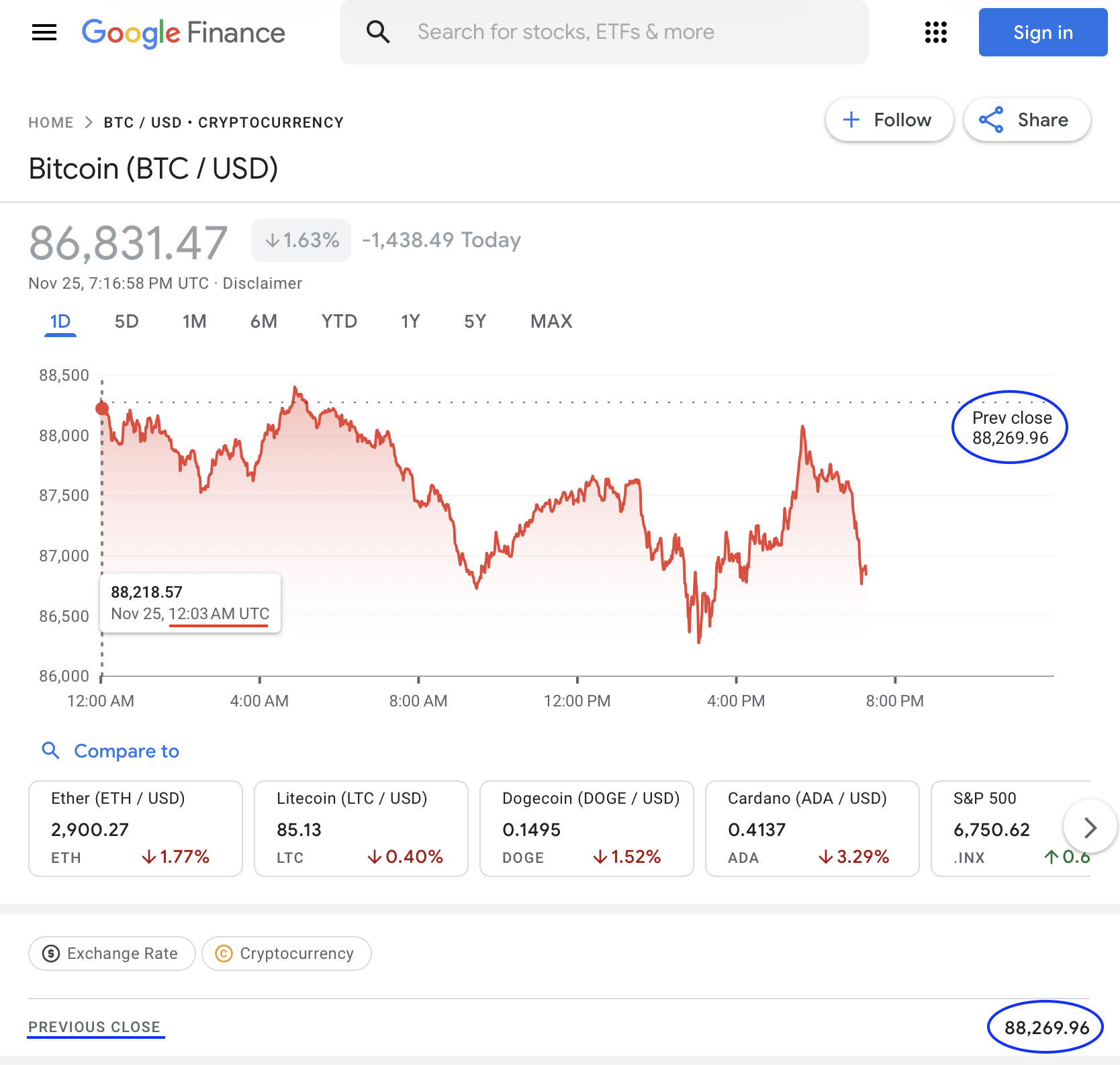

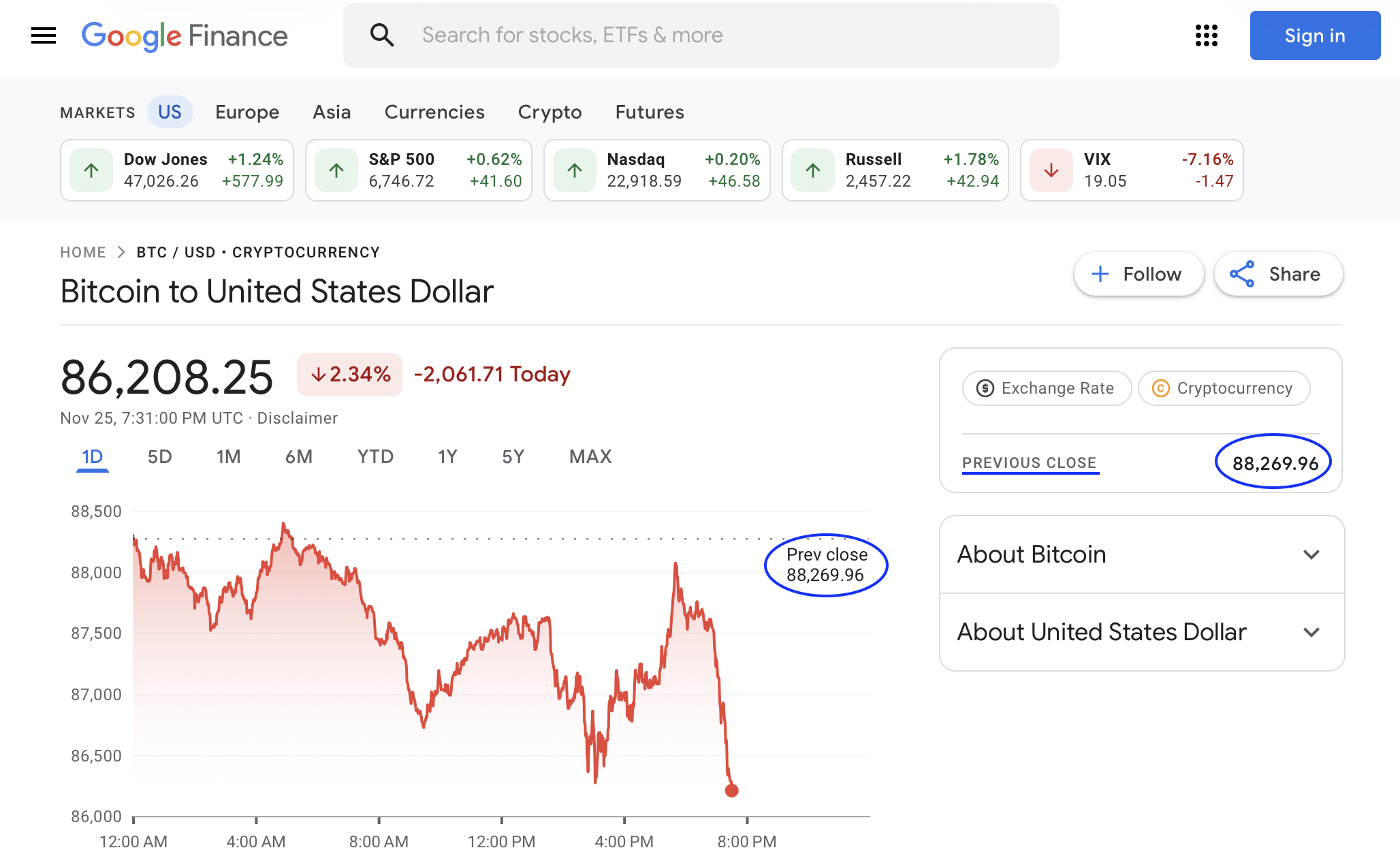

Update 2025-11-25 (PST) (AI summary of creator comment): The creator has confirmed they will use the "Prev close" value shown on Google Finance for resolution, which represents the closing price at midnight UTC (one hour after CET/French time, not at 11:59 PM CET as originally stated in the description).

[...]at the end of November 28, 2025 (11:59 PM CET / French time). The price will be determined using Google Finance. Resolution will be based on the closing price displayed on Google Finance for that date.

I think Google Finance shows the close each day based on UTC time, so an hour after CET/French time. But perhaps there's a way to set the timezone that I haven't figured out, or requires signing in.

@deagol I'm viewing this in the French time zone.

However, it's one hour behind my current time:

It's 11:14 PM here, but on Google Finance, I see the value at 10:14 PM.

@InvestorOakmont ok so I think it's best to align with the Google close (UTC) and not mention French time? and maybe add an hour to the market close time, if you want to allow trading to continue right up to the deadline.

@InvestorOakmont in Google it can be tricky to tell which figure is which. The figures shown when hovering over the daily chart (highlighted in red below) are more ephemeral than the "Prev close" value they give, which is at midnight UTC (so an hour behind you) and will remain static throughout the next day (highlighted in blue below). The later is what I think we should use, and mostly aligns with the description here (except it's UTC not French time).

@InvestorOakmont well, I can't get that exact 12:00 point to display in my browser, I get it for 12:03 and maybe 12:02 if I stretch the window just right. That's what I meant by those "hovering" figures being more ephemeral (maybe not the right word, it's just not exact at a precise and consistent timestamp). But if you follow the dotted horizontal line from the y-axis toward the right, on the other side of the chart it shows "Prev close". The same figure is displayed in the infobox below the chart (or to the right if your window is stretched further as in the second screenshot below), and I'm pretty sure that figure would match on your side as well.

@InvestorOakmont the one I highlighted in blue "Prev close" aligns best with the original description. Note that it's only displayed for 24h after each day's close.

@InvestorOakmont also remember the resolution event happens one hour after this market's close time (market would be closed for the final hour), and you can reset it by clicking on the clock/time on the top right. Leaving it as is now is fine too, it'd just prevent us traders from squeezing out the last drop of liquidity by betting to 1% or 99% (if it's close enough to 80k to make us uncertain), and the left over will be returned to you upon resolution.