Related to ACX five year predictions. I will resolve this based on my impression of the consensus of economists at that time. By "visible break", I mean clearly larger than ordinary year-to-year variation, and widely remarked upon.

Update 2025-19-01 (PST) (AI summary of creator comment): Clarifications:

A direct effect of AI refers to economic changes directly caused by AI itself, and does not include effects resulting from phenomena like an AI industry bubble bursting.

@JacobPfau from the context of this being Scott's 5-year predictions (introduced in the second half of this post: https://open.substack.com/pub/astralcodexten/p/grading-my-2018-predictions-for-2023?utm_source=share&utm_medium=android&r=f99j5), I'm assuming the consensus needs to exist by 2028, since that's when Scott will be grading his predictions.

On the one hand, I'm as biased as I could possibly be, as I'm the biggest NO holder and this is my biggest position on Manifold. On the other hand, the reason I've let myself get so exposed is because I think it's fairly clear that the close date is the close date. I think it's very likely that AI will cause a macroeconomic break soon, but not soon enough for consensus to form by 2028.

@Fion I'm also betting NO because I think it's a bit too soon. I suppose I should've clarified what "by 2028" meant exactly, although in my case I'd probably be betting NO either way. I do think that's on us and Scott should just clarify it in whatever way makes sense to him. He shouldn't be pressured because of how we bet based on what we presumed.

@dreev I see where you're coming from, and I support the principle that the creator's word is law. But there are cases where the market creator "clarifies" something that (arguably) goes against the logical reading of the original criteria, and it's fair game for bettors to complain and argue their case when that happens.

And while I think Scott is great, and I'm glad we have his markets on Manifold, I think it's fair to say that he's a bit of an absentee creator, rarely responding to requests for clarification and meaning we have to rely more on our own interpretation. With a more active creator, I'd be more patient and wait for a ruling before deciding if I wanted to complain about that ruling. But given that I don't really expect a ruling in a timely fashion, that makes me more inclined to get my arguments out in the open early!

In this particular case, I think if the close date was moved to allow longer for expert consensus to form, it's more a case of "misleading" than "ambiguous".

(But you're right, I'd probably still be betting NO even if a retrospective analysis was allowed. But maybe I wouldn't have staked 25% of my net worth on it!)

@Fion All fair points. This reminds me of my market about whether Tesla would launch level 4 robotaxis by August 31. I'm not moving that deadline but I'm extending the close date because there's no consensus on whether the thing Tesla launched counts as level 4 (unsupervised) autonomy. I think it will become clear in retrospect at some point in 2026 at the latest so I think it's most fair to wait till we know.

And now that I say that, and despite it being against my interest, that's what feels fairest to me for this market. GDP has to go crazy by the end of 2027 but if the economic data isn't in by the next day, that shouldn't mean an immediate NO resolution. It just means we're not sure yet if the predicted thing happened.

Which is to say, I agree with @JacobPfau that resolution should be delayed as needed until we know whether GDP went crazy by the end of 2027. I'm still betting that it won't do so that soon.

Edit: big market resolved. Offer closed

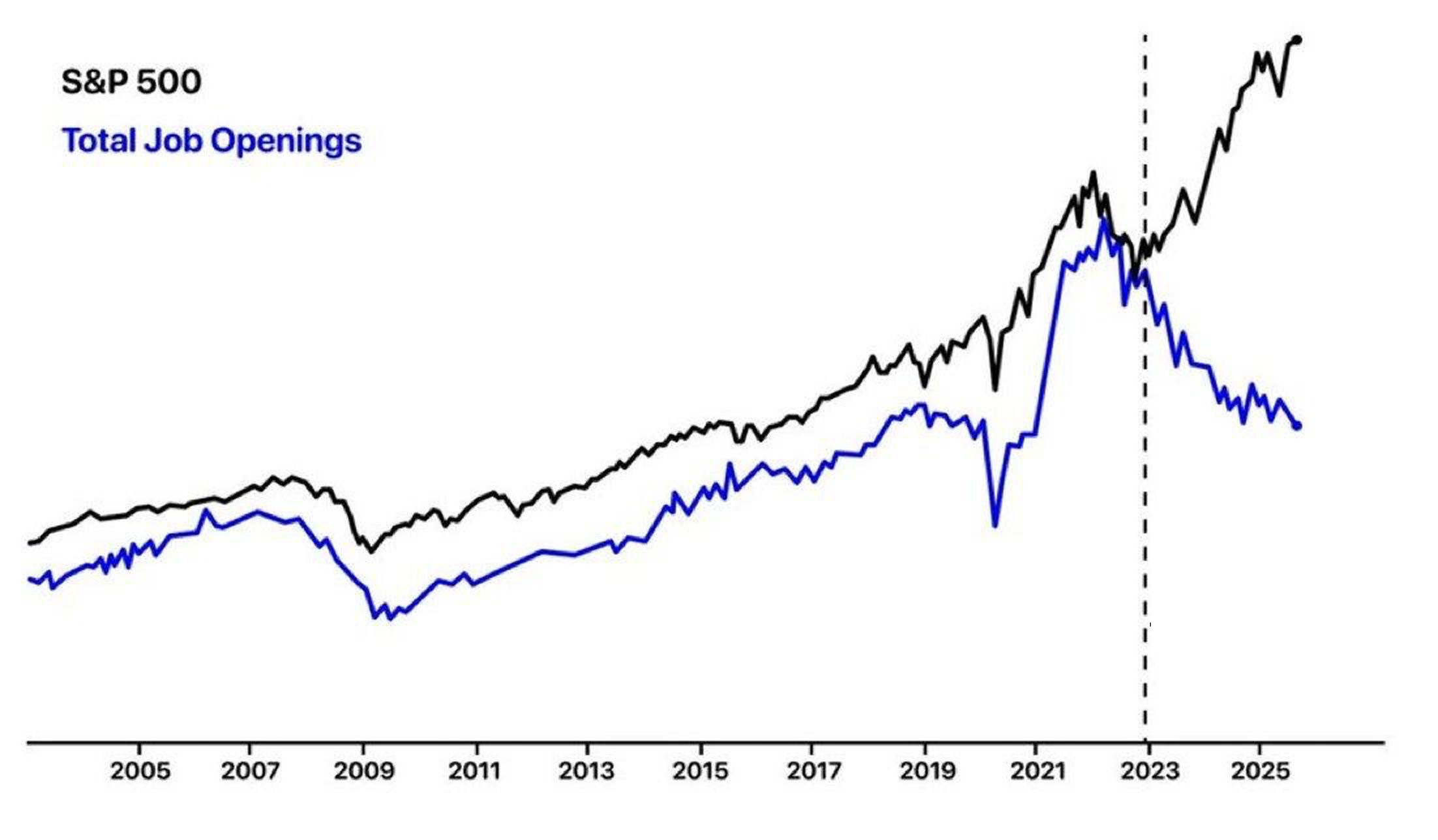

A macroeconomic signal credibly attributable to AI? (Unemployment - recent college grad unemployment) https://x.com/DKThomp/status/1917626264455700847

@AdamK I would like to know whether such signals (if ai attributable) suffice @ScottAlexander ? Or do only nation/economy wide numbers count?

@JacobPfau I assume it has to be one of US GDP, GDP per capita, unemployment, or productivity, on the national level.

Just to let everyone know (especially YES bettors), the recent drop in this market from around 40% to 30% where it is now, was (I believe) driven almost entirely by me and not based on any analysis of the actual state of AI development or economics. Rather, I just had a bit more spare mana and decided to bet more aggressively.

So if you're a YES bettor worrying that developments have turned against you, don't be afraid. Come and fill my orders.

(Unless there have been developments to change the underlying probability coincidentally at exactly the same time that I started being more assertive, but that seems unlikely.)